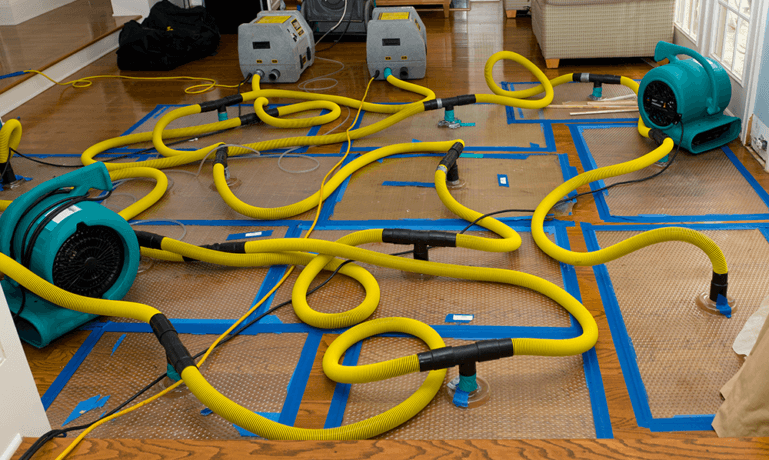

I HAVE WATER DAMAGE IN MY HOME OR BUSINESS DUE TO A PIPE BREAK!! SO WHAT DO I DO NOW?!

As this article goes to print, Texas residents and business owners will have suffered hundreds of millions of dollars in property damage due to the recent Arctic outbreak that migrated to the Lone Star State. Homes and business throughout the southwest are facing consequences because water pipes are breaking. The effects of this meteorological phenomenon is…